Weekly Summary: August 23 – 27, 2021

Key Observations:

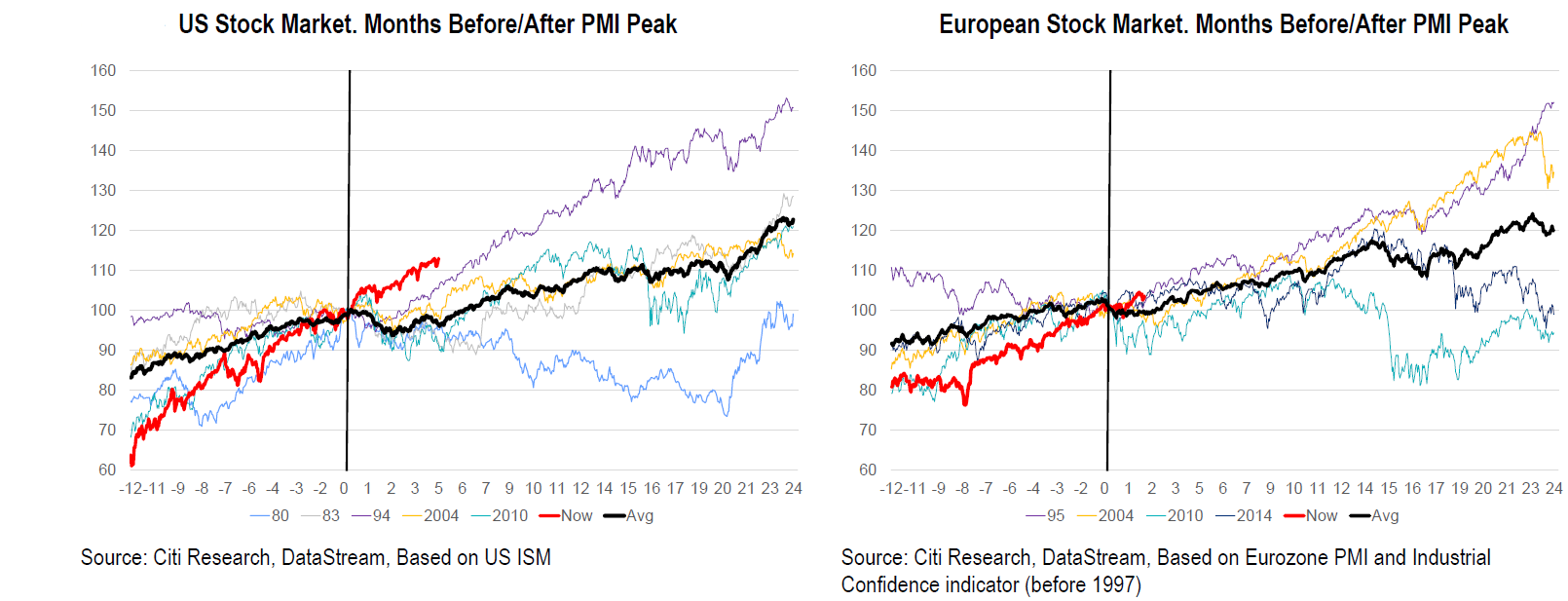

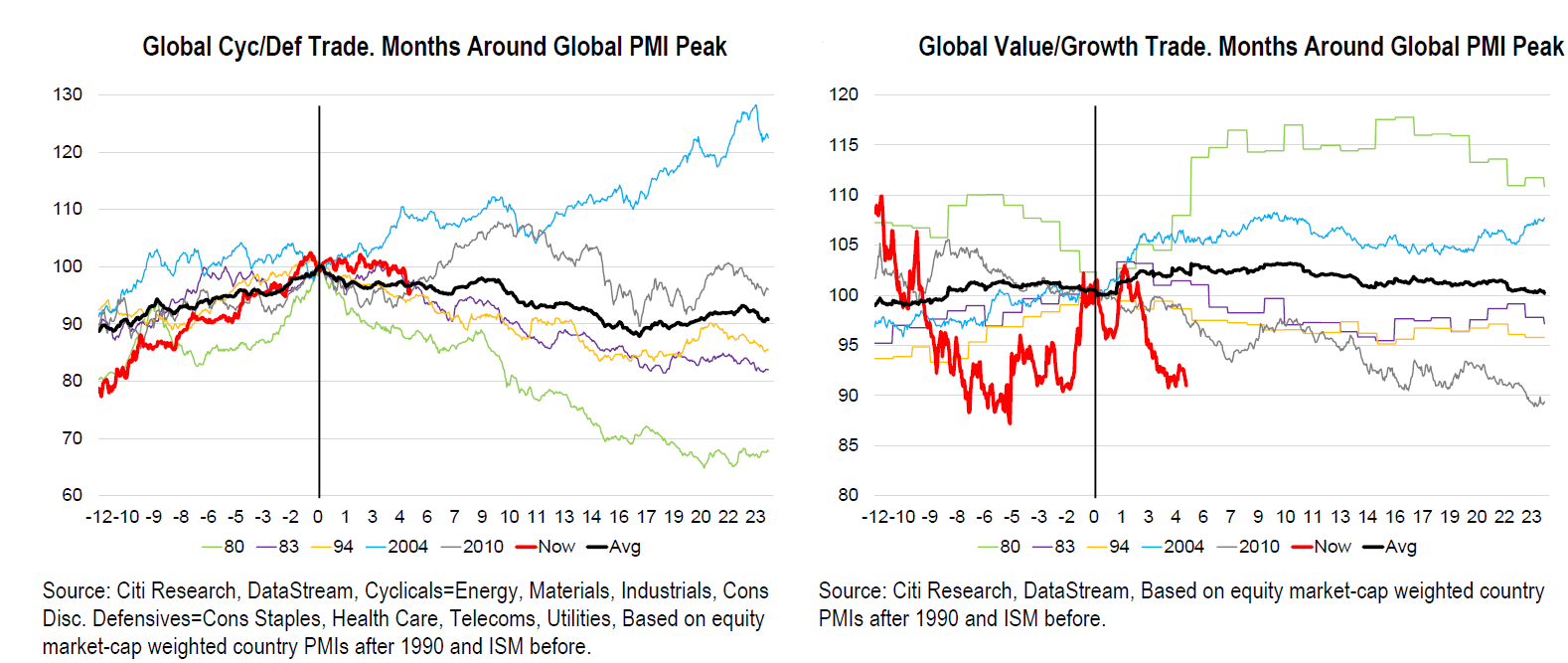

- Post peak economic growth can still be very favorable for Value and Cyclical stocks, as well as for equities overall.

- Given the great dispersion of economic growth and inflation expectations, shifts in market sentiment can be abrupt when a particular scenario is “overly” discounted.

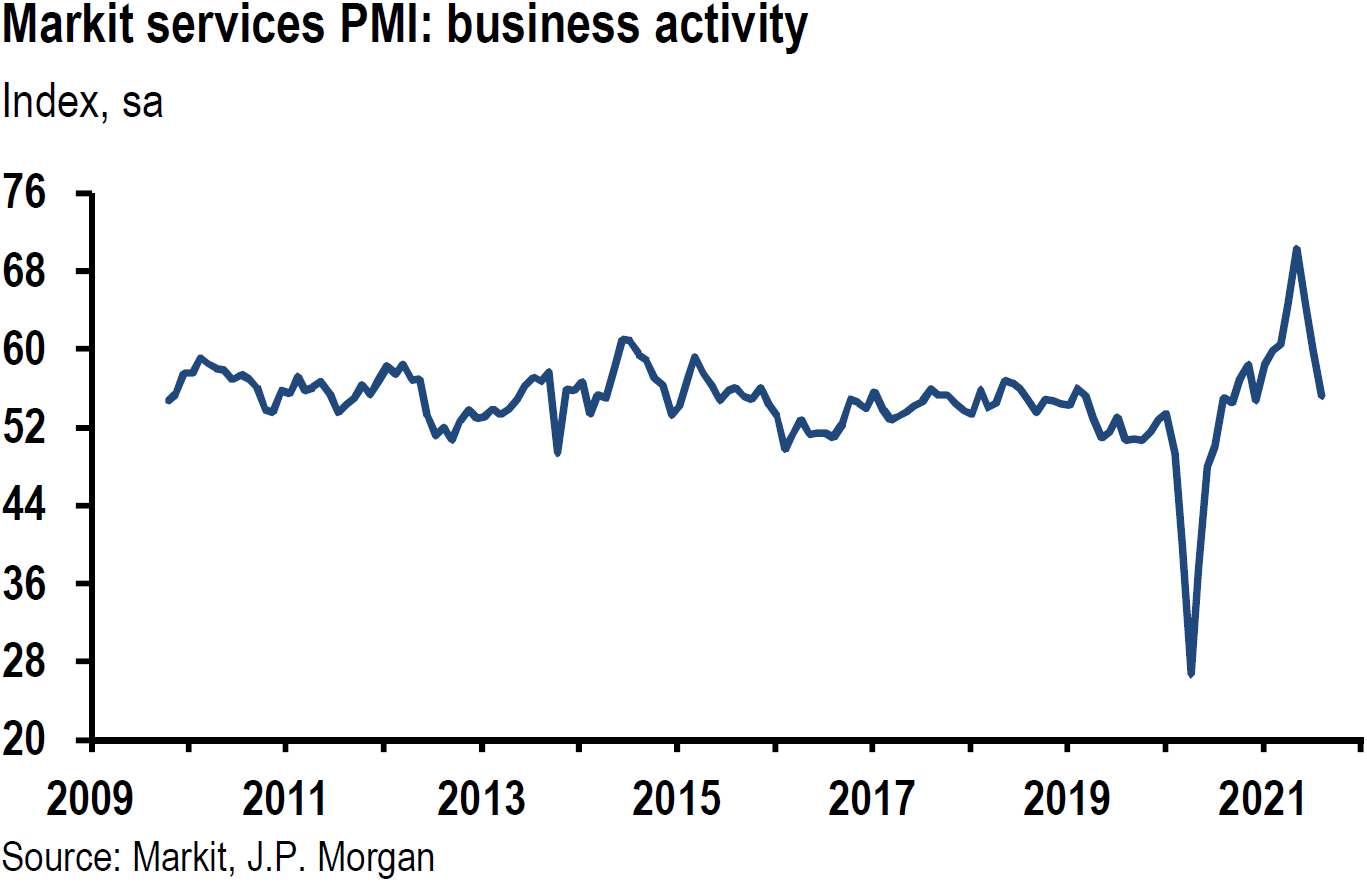

- Services PMIs appear to be more idiosyncratic depending on a particular country’s labor situation, coronavirus infection and vaccination rates, as well as the timing and extent of its economy’s reopening.

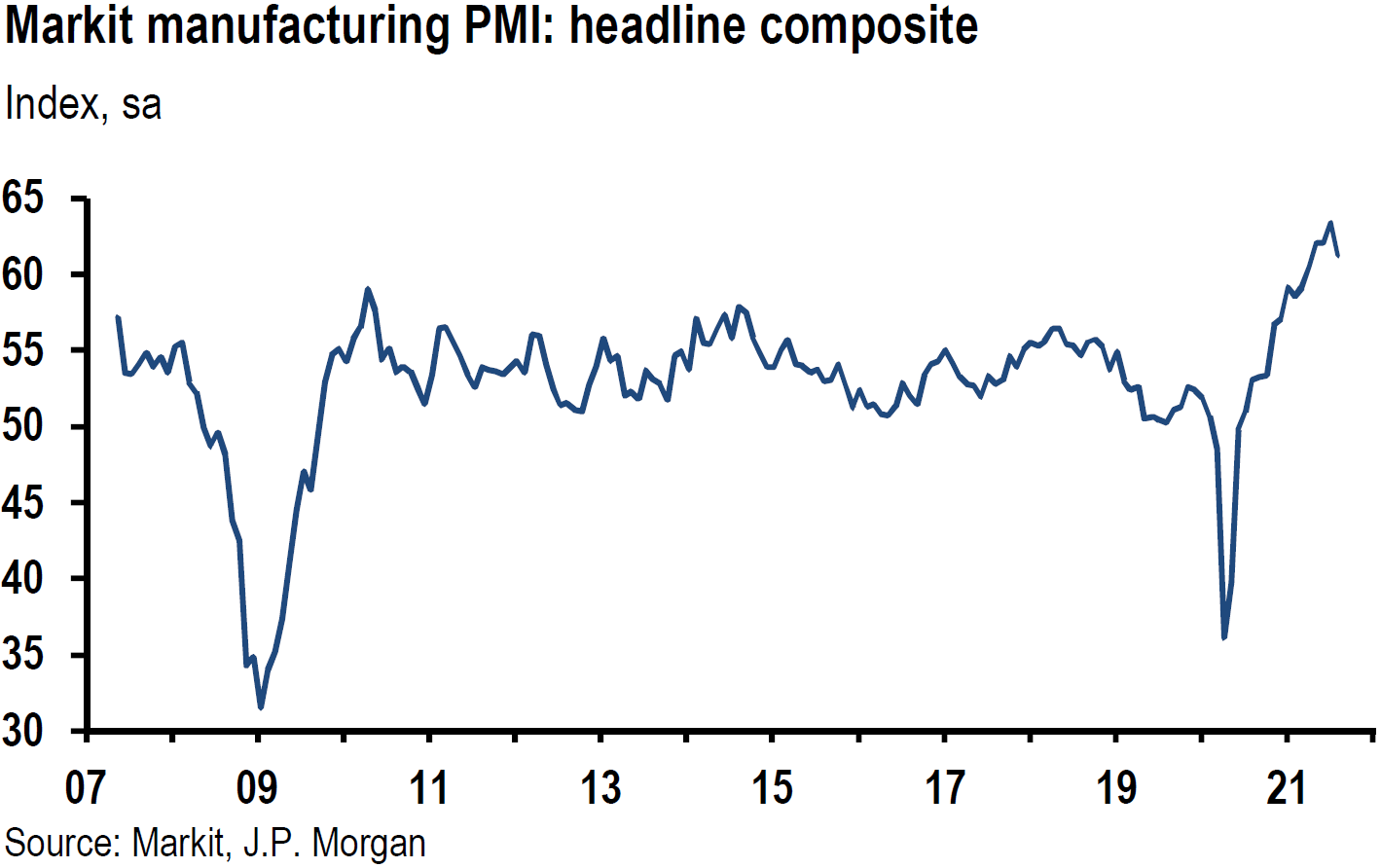

- We view manufacturing PMI’s as being more influenced by global factors, such as supply chain issues and disruptions.

The Upshot: We remain confident that the rolling global economic rebound remains intact, if not delayed. We believe that at current prices, a risk/reward analysis continues to favor Value and Cyclical stocks. We also favor U.S. stocks with international exposure as well as selected European stocks to take advantage of the rolling nature of the sustained global economic growth. We don’t think it’s too early to have long exposure in emerging market (EM) stocks as well. We continue to hold core positions in big cap growth stocks.

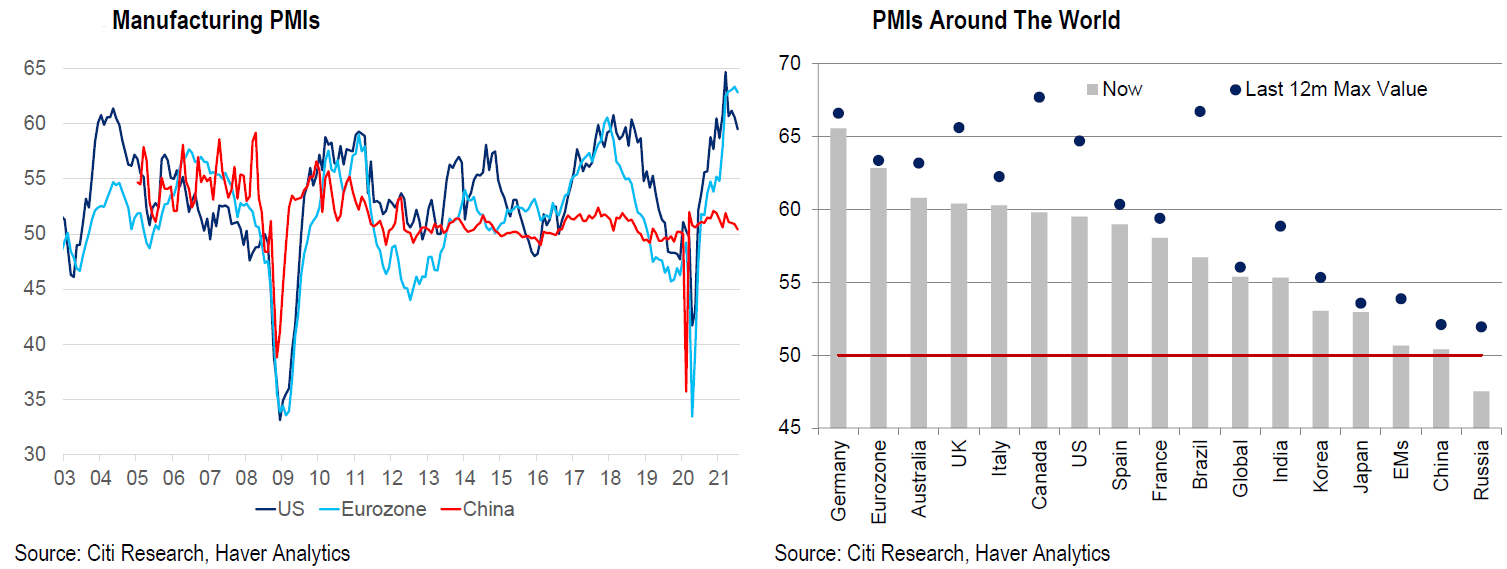

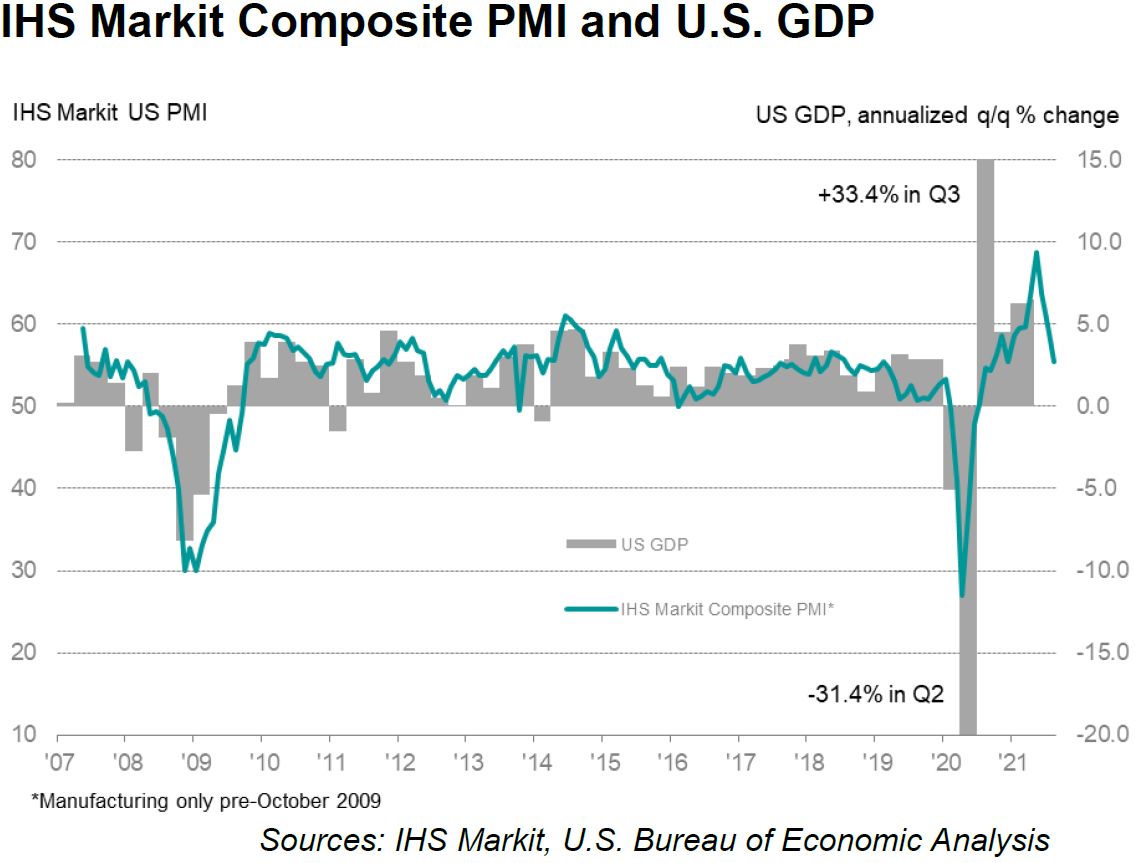

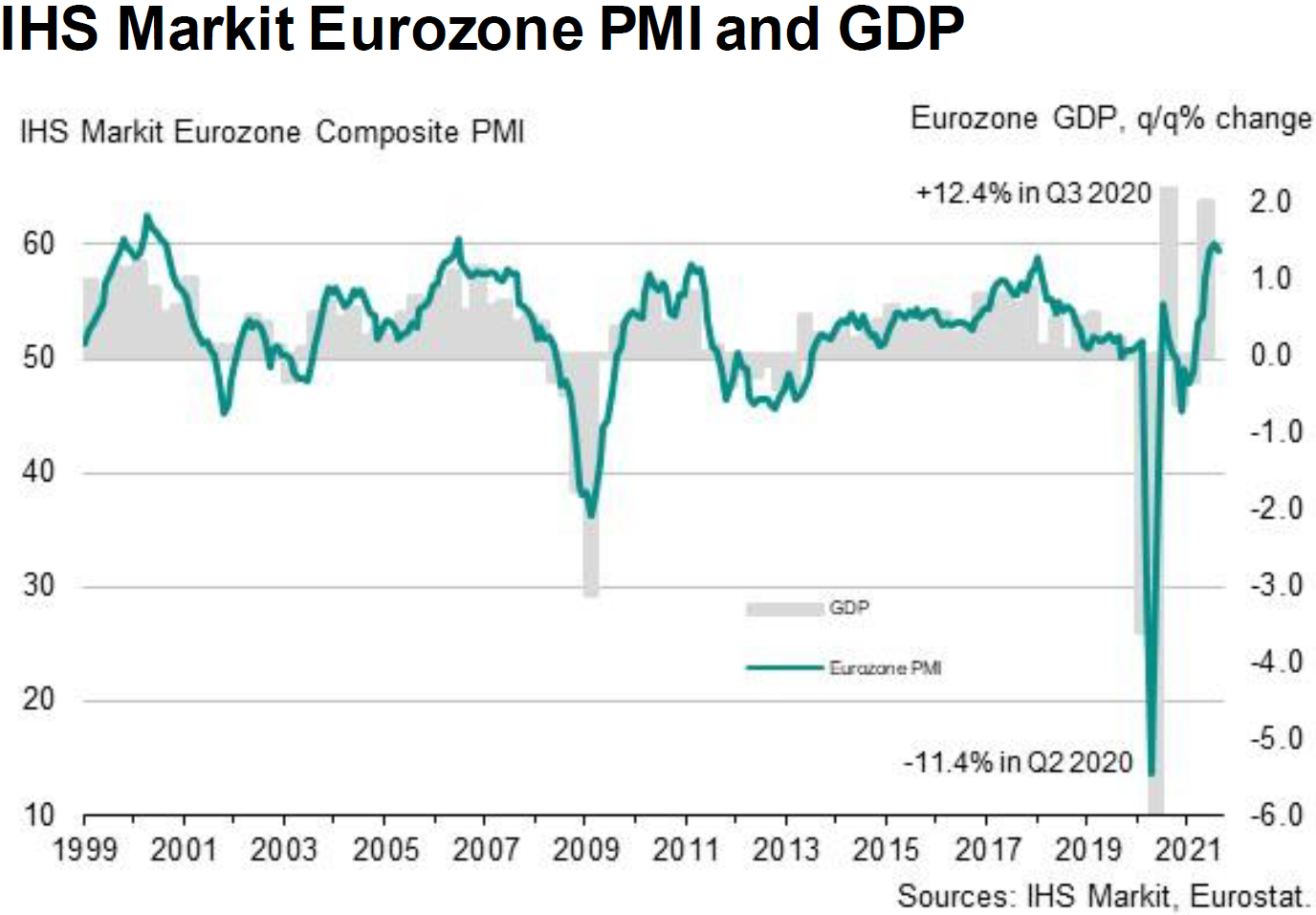

The week began with the generally disappointing announcements of IHS Markit Purchasing Managers’ Index (PMI) for the eurozone, U.K. and U.S. This data is compiled from surveys of business executives and indicate the prevailing direction of economic trends in the manufacturing and services sectors. Although generally weaker than expected, the PMIs still showed underlying momentum for strong economic growth. As we have stressed in prior weekly letters, peak growth does not equate to a lack of further economic growth.

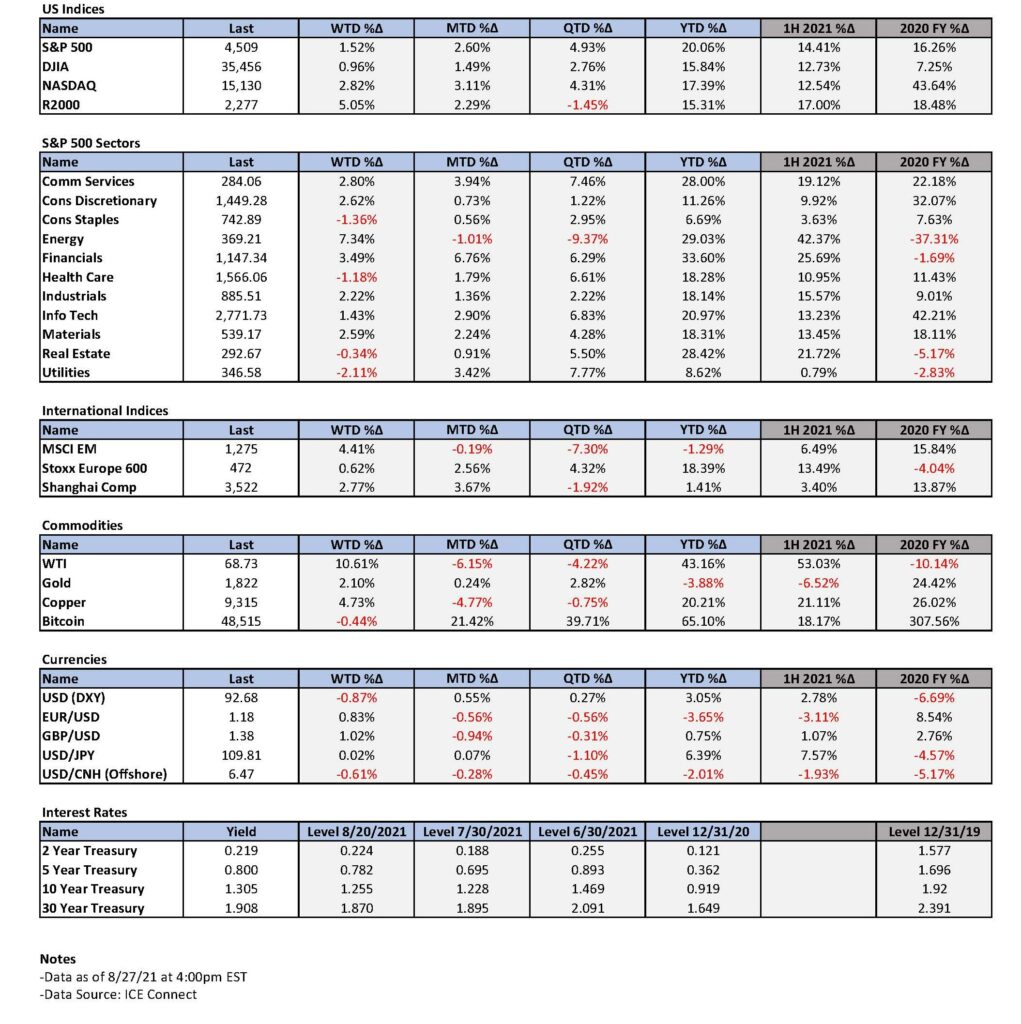

The first three days of this week showed a very clear and dramatic financial market reaction to the still remaining and powerful underlying economic growth trends. Value and Cyclical stocks clearly outperformed Defensive and Growth stocks. Commodities such as oil and base metals all rebounded strongly, U.S. Dollar index (DXY) lost about 0.6%, and the 10-year Treasury yield increased by about 9 bps to 1.34%. The markets clearly understood the difference between peak growth and continuing economic growth.

Shifts in Market Sentiment

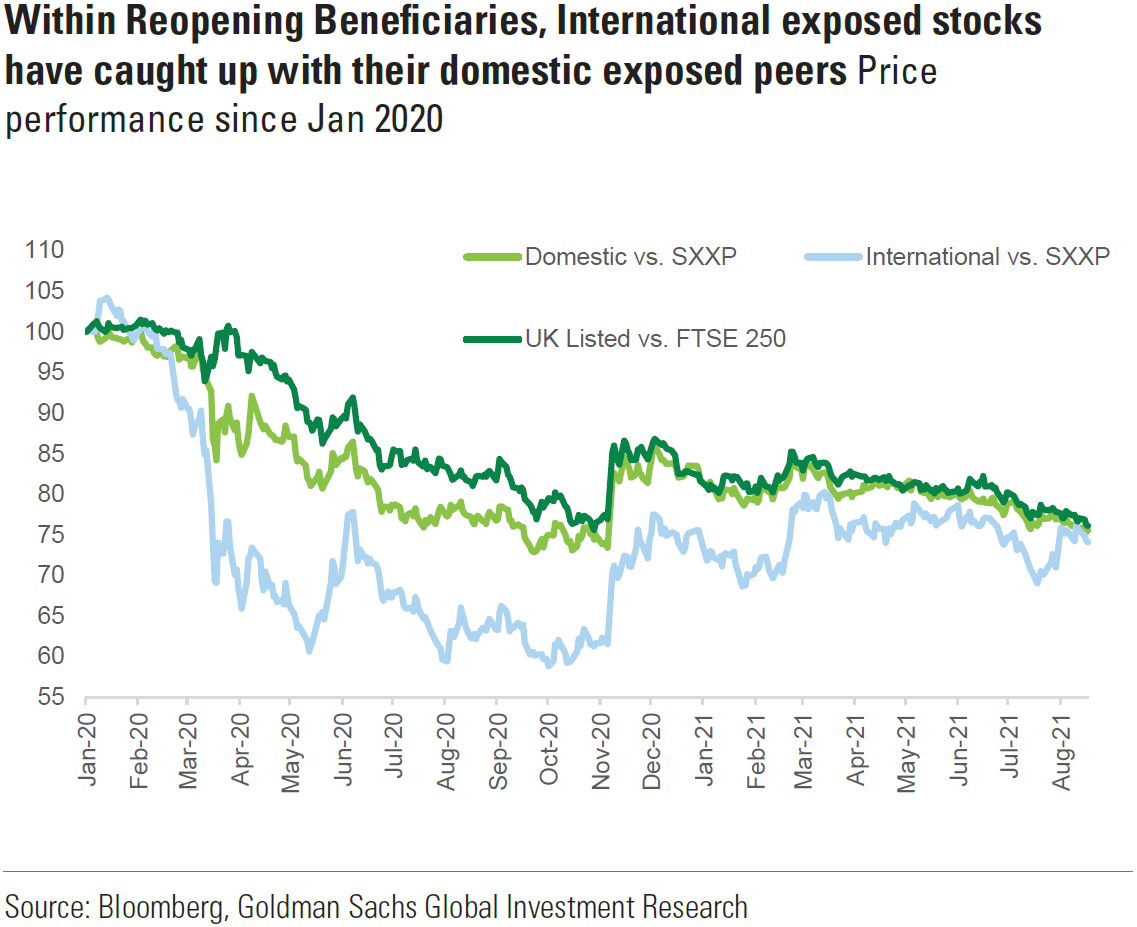

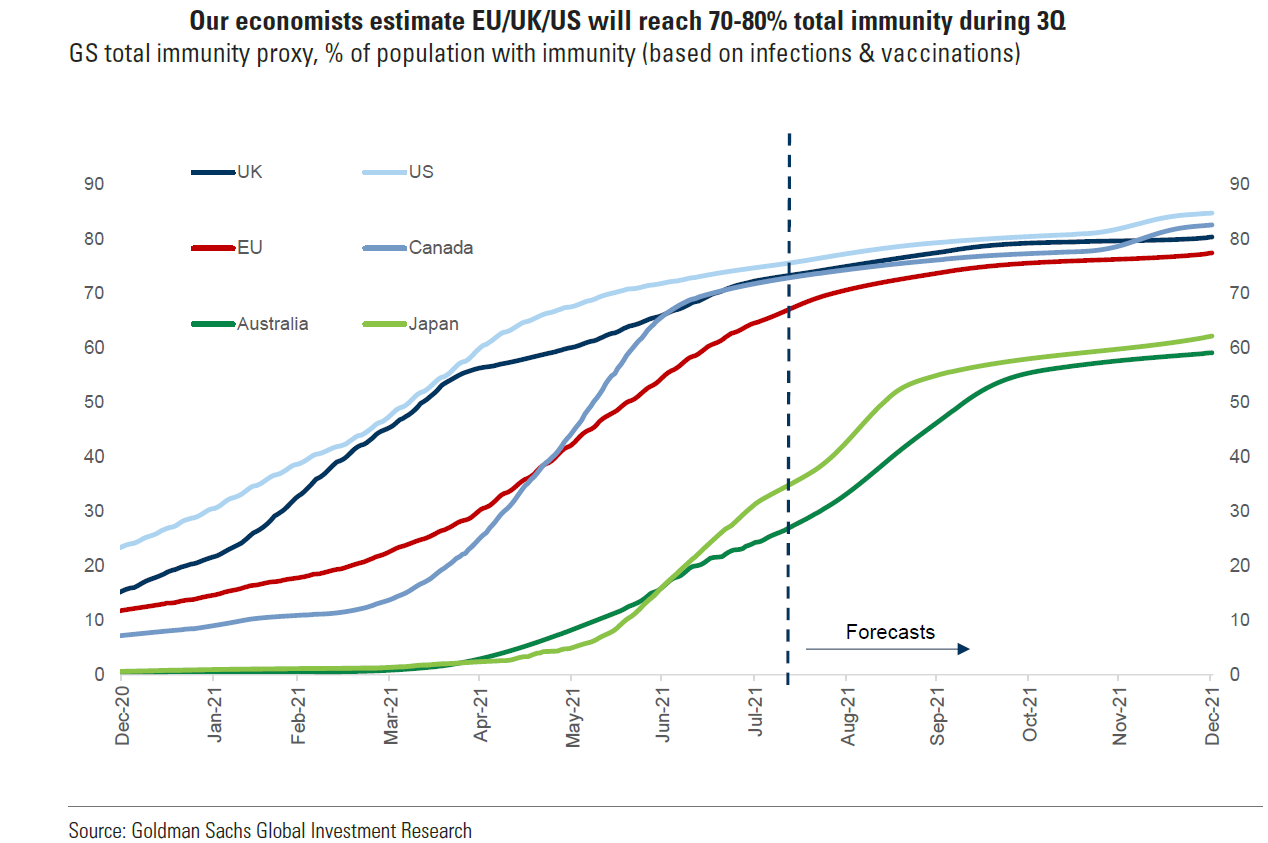

This week, the markets seemed more comfortable with assuming that negative effects from the Delta variant will be manageable and not very long lasting. We maintain our belief that the global “rolling” economic expansion will continue as we expected, even if it is somewhat delayed due to the Delta variant. As the Delta variant progressed, worries of slowing economic growth rates recently provided very attractive entry points to establish and add to Cyclical and Value oriented investments. We recommended taking advantage of such opportunities, as we believed that these sectors were overly discounting a substantial decline in economic growth. The beginning of this week started to show the rewards for exhibiting patience and only adding to such investments on pullbacks. Of course, we do not mean to imply that volatility will disappear. We also continue to favor international exposure through U.S. stocks with substantial overseas operations as well as selected European stocks. We don’t believe that it’s too early to establish EM long positions in anticipation of the rolling global economic recovery.

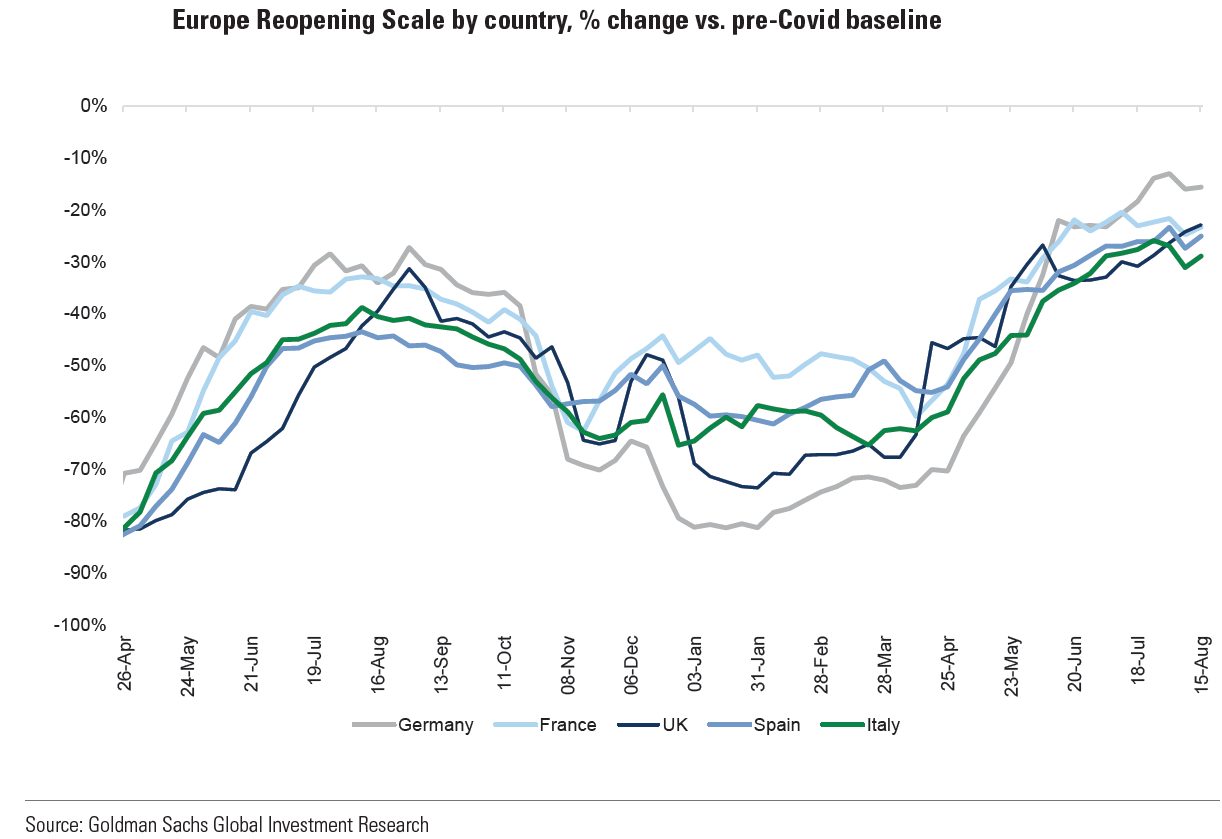

Source – Goldman Sachs, The GS Reopening Scale for Europe – Week 27: Two-speed reopening (8/23/2021)

Variables by Country

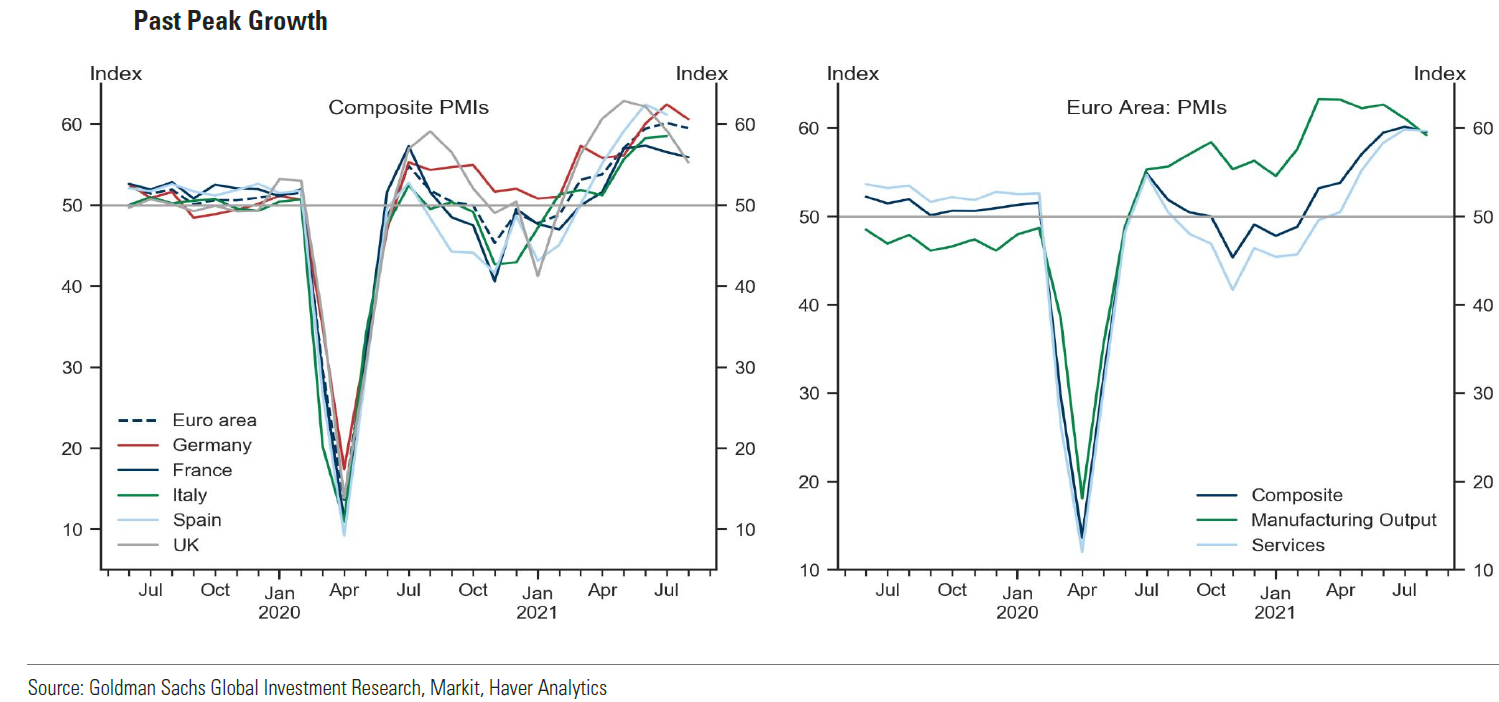

The variability of vaccination rates and levels, policy differences, and the interrelationships among the economies of various countries could be discerned from an examination of the PMI data. Policy differences have included various approaches to monetary and fiscal policies as well as pandemic- related restrictions. The timing of all these factors has proven to be very important in understanding their full import. The key assumption in buying the dips in our desired sector allocation is that the economic recovery will be sustained.

Source – Goldman Sachs, The GS Reopening Scale for Europe – Week 27: Two-speed reopening (8/23/2021)

Comparing PMIs

A striking difference between the August PMIs of the U.S. and U.K. on one hand and the eurozone on the other is that both the U.S. and U.K. exhibited a rather dramatic and unexpected decrease in their services PMIs, with a more muted decrease in their manufacturing PMIs. According to IHS Markit, the U.K. services PMI shortfall was attributable to wage inflation, staff shortages and their effects on costs and margins.

The U.S. services PMI was similarly plagued by hiring difficulties and supply chain delays and expanded at its weakest pace since last December. The U.S. services employment sub-index fell close to its recent February low and the manufacturing employment sub-index fell to its lowest level since last December. In both cases, the relatively low level of the employment components was due to the difficulty in hiring suitable workers and not for lack of demand. Because of the pandemic’s negative effect on outputs, the U.S. manufacturing PMI surveys showed a greater optimism regarding output over the next year as most assumed a more normal environment.

In contrast, the eurozone (EU) PMIs showed that services momentum slowed less than manufacturing PMIs as EU virus related restrictions had largely disappeared by August and were generally considered to be at their lowest level since the pandemic began. In fact, for the first time in about a year, the EU’s services PMI surpassed that of the manufacturing PMI (59.7 vs.59.2). EU manufacturing PMI hit a six- month low in August, while services PMI was at a two-month low. But for the second straight month, the EU’s job creation in August was its strongest in 21 years. The chief business economist at IHS Markit described such job creation as firms trying to boost their capacity to meet strong demand.

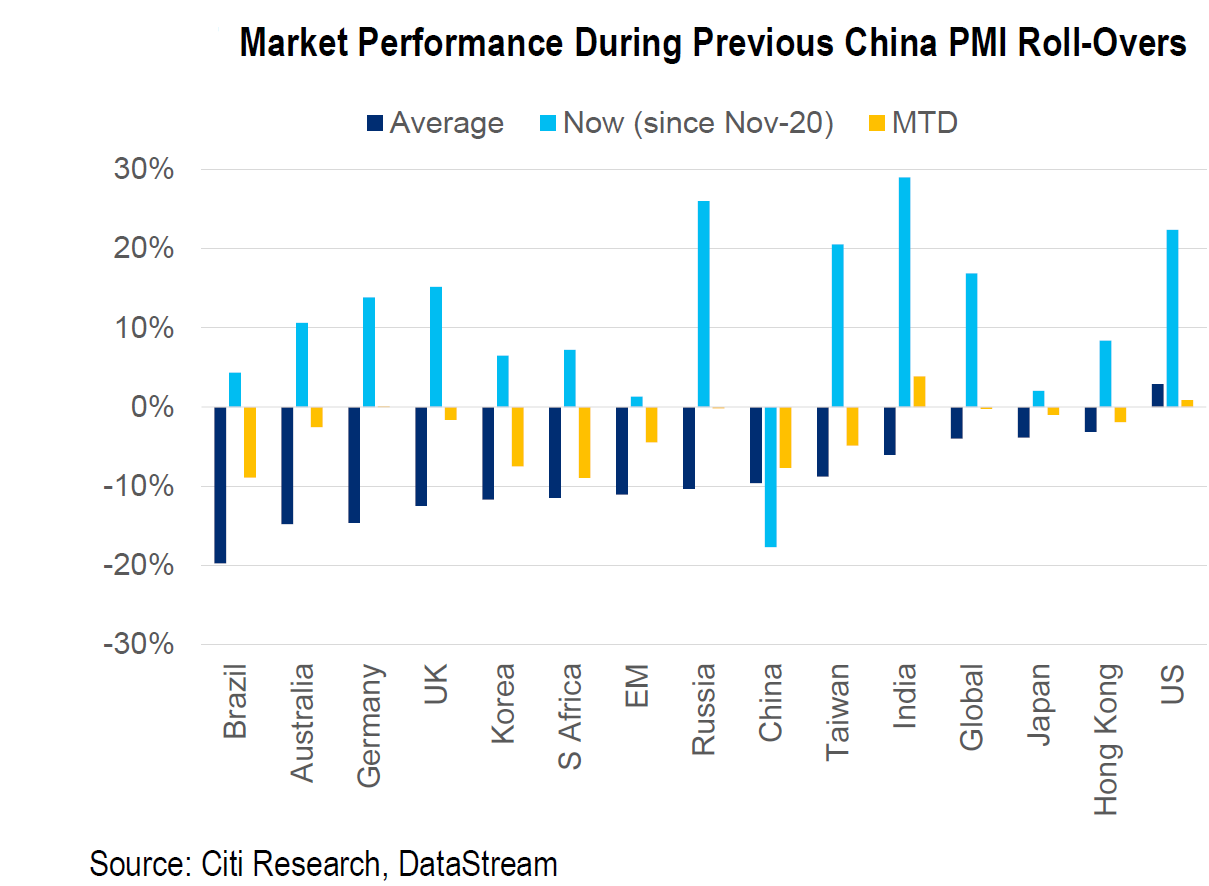

Source – Citi, Global Equity Strategy – PMIs Rolling Over: Equity Implications (8/25/2021)

Source – JPMorgan, US: PMI data weaken in flash August reports (8/23/2021)

Source – Goldman Sachs, Europe: August Flash PMIs Indicate Growth Moderation (8/23/2021)

Source (left) – IHS Markit, Private sector expansion slows sharply amid capacity constraints and Delta variant spread (8/23/2021)

Source (right) – IHS Markit, Eurozone flash PMI holds close to 15-year high, job market booms (8/23/2021)

Shared PMI Characteristics

Although all of the above August PMIs were generally below expectations, they all indicated that their economies were still firmly in expansionary territory. In general, they also share lowered output levels and higher prices due to the negative effects from the Delta variant. Common characteristics included delivery times remaining very long, work backlogs remaining very high, shortages of materials and components leading to supply chain disruptions, and prevalent cost pressures. Higher prices received were also common.

High Beta Characteristics of EU Relative to Global Economic Growth

We believe that the underperformance of the EU’s manufacturing sectors relative to its services sectors is largely because its economies and equity markets are more cyclically oriented than the U.S. In other words, EU companies’ earnings and stock prices have a relatively high beta (a measure of sensitivity and volatility) to global growth.

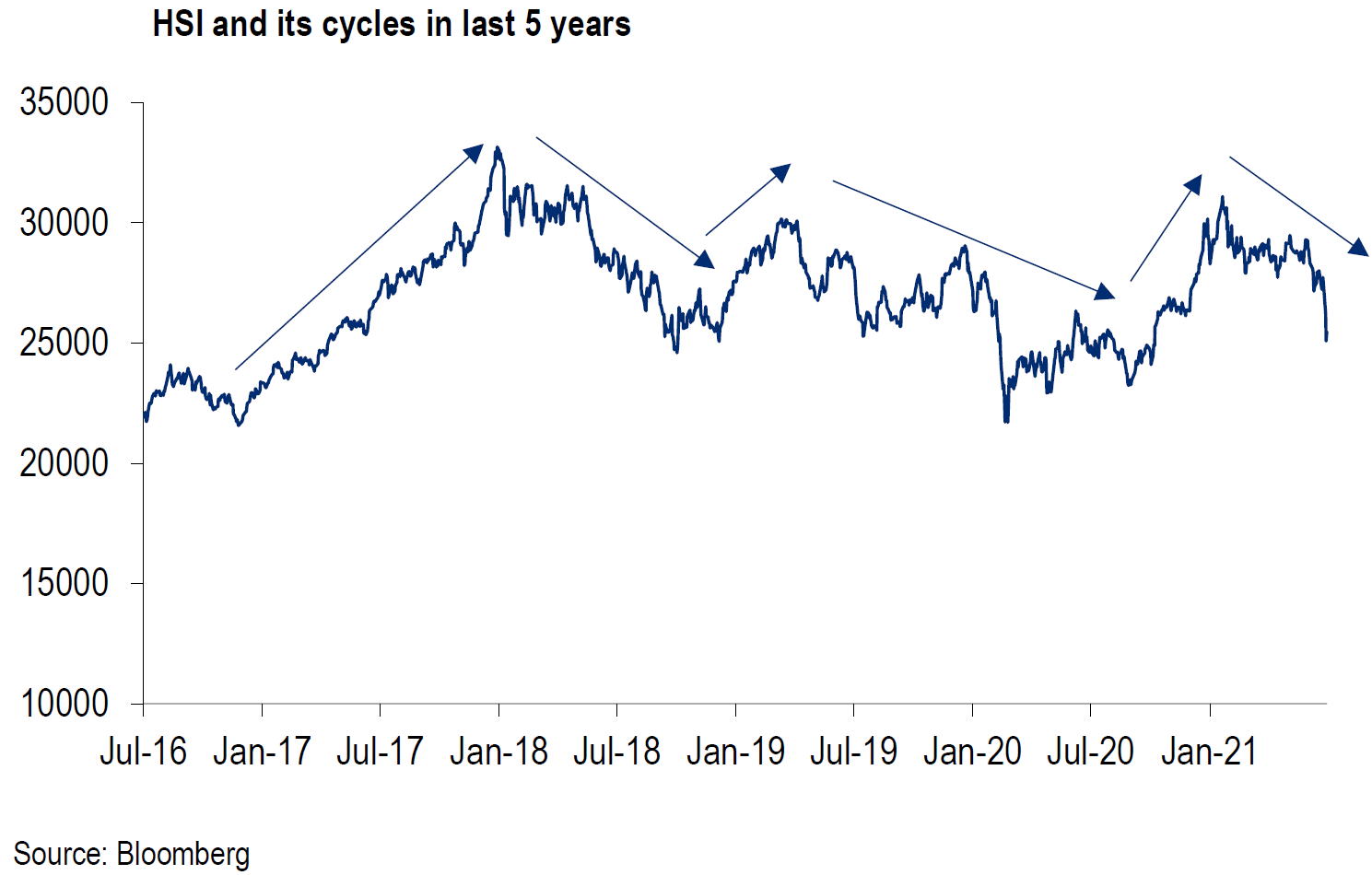

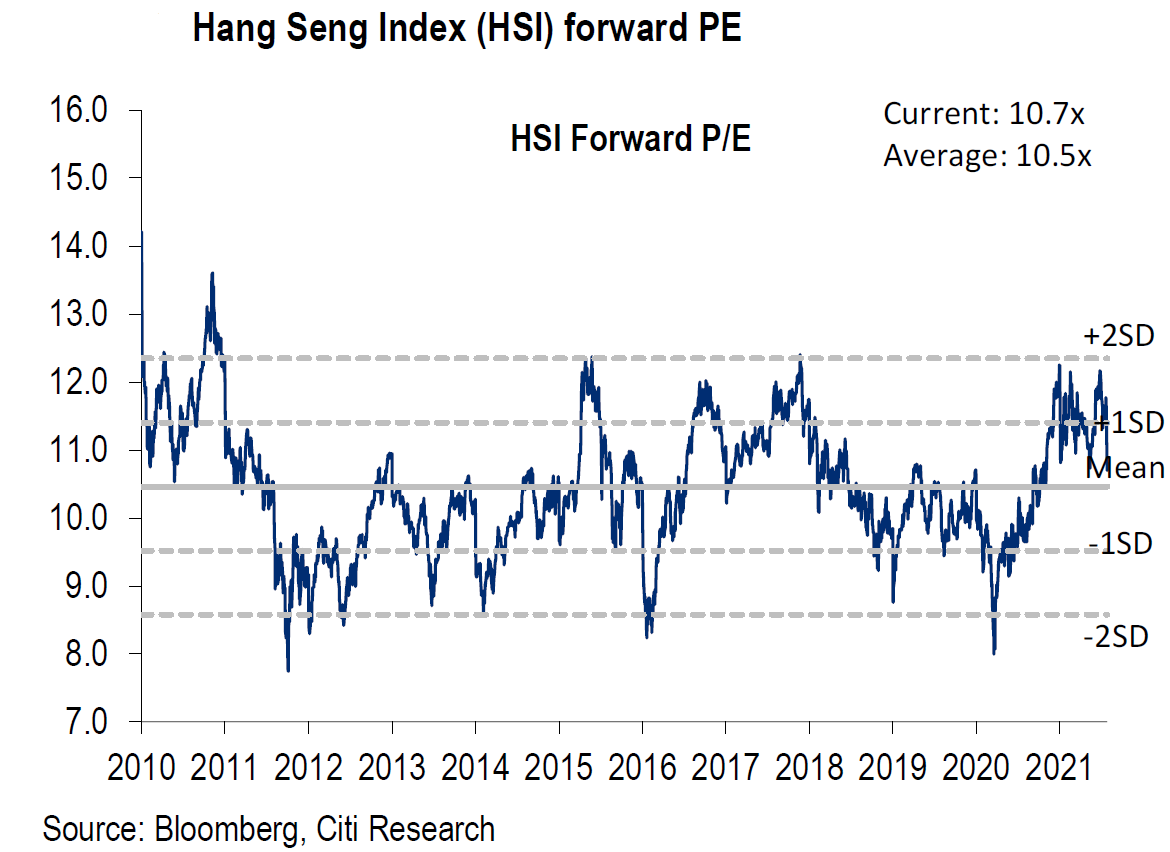

Furthermore, the EU’s largest economy, Germany is especially sensitive to the ebbs and flows of China’s economy. Earlier this year, the Chinese government chose to shift its policies away from general growth to focus on promoting social equality, a zero-carbon emissions policy, higher-quality growth and restraining the excess leverage in its property sector. According to an August 22 Citi Research report, the origination of long-term household and corporate loans was halved in July when compared to June originations. China’s July credit expansion grew at the slowest pace since February, 2020.

China Economic Slowdown and Recovery – Mostly by Choice

As indicated in last week’s letter, the recent slowdown in many economic measures for China has been more pronounced than consensus expectations. We are confident that sometime over the short to medium term, China will shift to more relaxed fiscal and monetary policies. But we believe that the relaxation of these policies will be more targeted.

Earlier this week, the chief of the People’s Bank of China (PBOC) indicated that the PBOC will keep monetary policy stable and support high-quality economic expansion with “appropriate money growth.” He further emphasized that the PBOC would enhance the structure of credit to ensure more funding for technological innovation, and green development, as well as more readily available credit for private smaller enterprises.

We look forward to the implementation of these more relaxed policies which will help promote economic growth in Germany, the EU and EM economies. Given China’s aggressive mobility restrictions in response to any coronavirus infections, however, supply chains could be disrupted unexpectedly at any time.

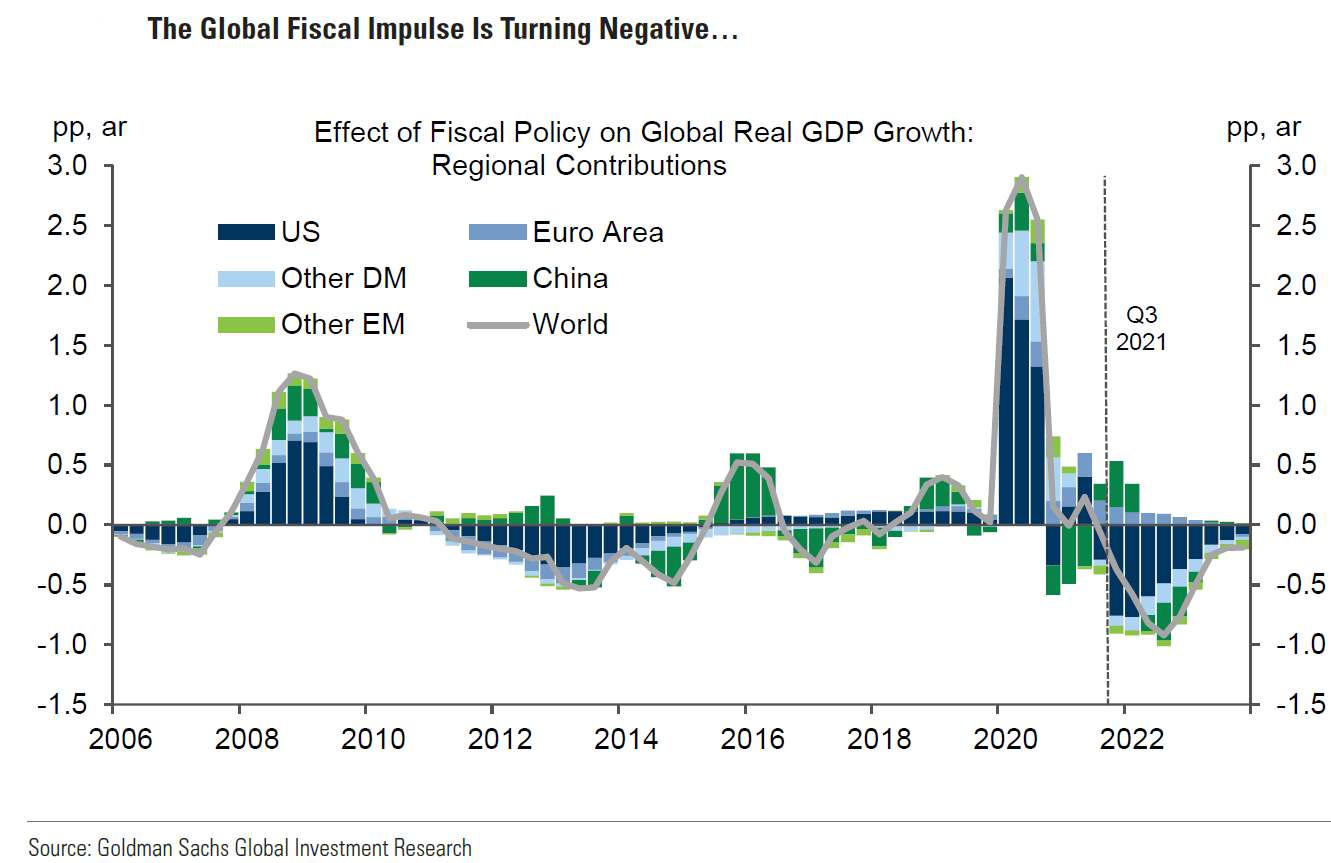

Source – Goldman Sachs, Global Economics Analyst Fiscal Come, Fiscal Go (8/24/2021)

Source – Citi, Global Equity Strategy – PMIs Rolling Over: Equity Implications (8/25/2021)

Source – Citi, China Equity Strategy: How to Mitigate Regulatory Risk? What Is the HSI Outlook? (7/28/2021)

Pandemic Makes Country Interrelationships More Complex

The pandemic has made the economic relationships among countries more complex and unpredictable. We still forecast that the rolling global economic recovery will progress as predicted, with a general pattern of peak economic growth rates proceeding from China to the U.S., followed by the EU and then EMs. The timing of fiscal and monetary policies for various countries, as well as any changes in them, will continue to impact the timing and economic growth rates of other countries and regions as well. But the rolling nature of the global economic recovery should help prolong global growth.

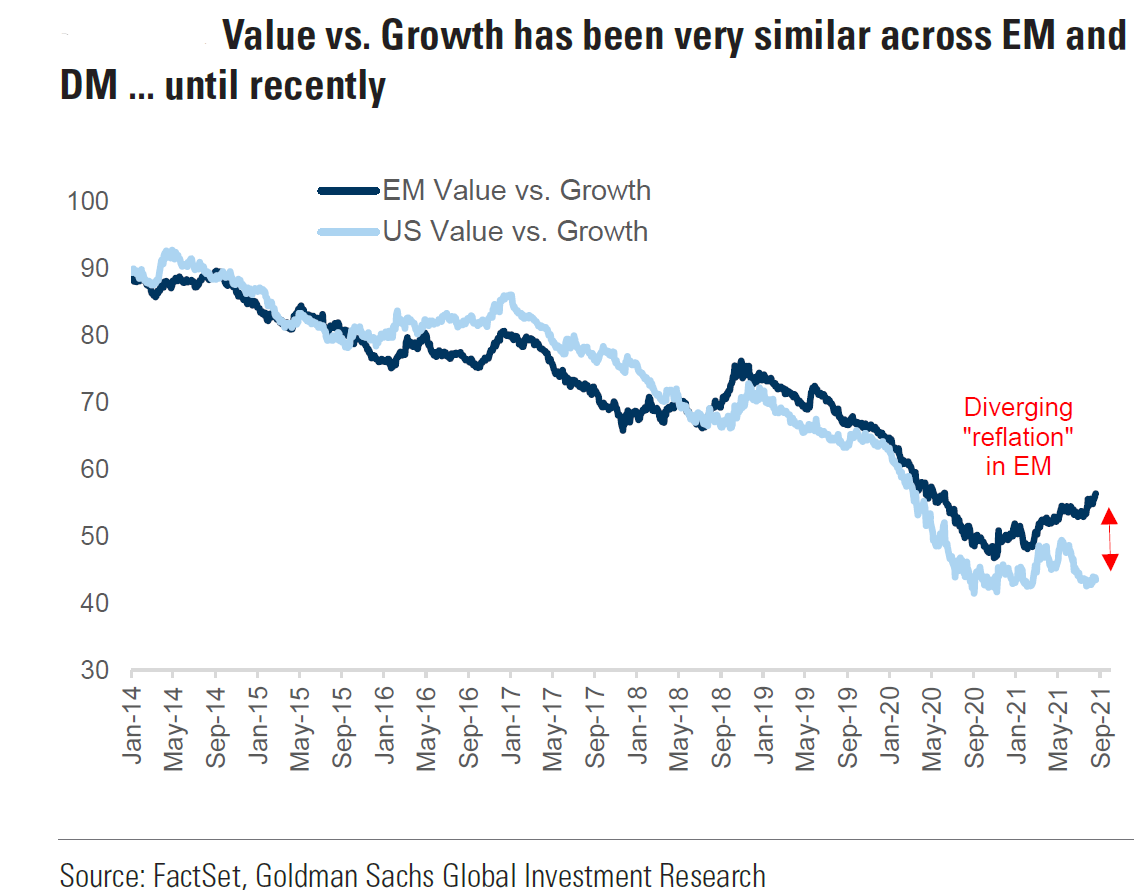

Relative to What? – It Matters

The interplay among various countries in regard to their financial markets can sometimes also have surprising effects on sector rotations and their outperformance and underperformance relative to other sectors. According to a Goldman Sachs August 24 report, although the MSCI Emerging Markets Index is about 13% below its February peak, EM value has outperformed EM growth by about 16% over that same period. But the more notable development is that this outperformance has continued even as this pattern recently reversed in developed market (DM) stock markets.

The volatility of Chinese stocks, especially in regard to their internet and tech sectors might explain the underperformance of EM growth stocks. China “represents” 37% of the Consumer and Technology sectors in EM and many of these Chinese stocks have recently suffered extreme losses in response to regulatory crackdowns. The answer to the question “relative to what?” is always important.

Source – Goldman Sachs, Global Markets Daily: EM Reflation is Still “On”, Under the Surface (8/24/2021)

Performance After Peak PMIs

Most global PMIs have rolled over in recent months. China’s composite PMI even peaked as early as last November. Historically, equity markets usually retreat after PMI peaks. They then typically recover when investors are convinced that economic growth will continue. But currently equities overall have continued to rally both in Europe and the U.S. after the peak of their respective rallies. The Cyclical and Value oriented stocks, however, have not been as fortunate. But much like the recoveries in equity averages seen during past PMI cycles, we continue to forecast a reemergence of outperformance of Cyclical and Value stocks over the intermediate term. Again, our critical assumption is that we remain in a global economic expansion.

Investor Sentiment Shifts Relative to What’s Discounted

Unexpected setbacks in the reopening of economies such as an increase in coronavirus infections due to the Delta variant cause more investor uncertainty around economic growth rates, inflation and interest rates. This uncertainty then leads to more volatility in regard to interest rates and to volatility among sectors. The dispersion of investor expectations enhances volatility. Investor sentiment remains very fragile and is subject to quick reversals.

In our opinion, sentiment is most likely to shift when financial markets have “overly” discounted a certain scenario. During the first part of last week, many Value and Cyclical type stocks were especially hard hit as the market (in our opinion) overly discounted slowing economic growth. Although the announcements of PMIs this week were below expectations, they nevertheless showed continuing underlying economic strength.

Evidently, this was enough to catapult prices of Value and Cyclical type stocks higher from a very attractive risk/reward level. The same was true for interest rates and the USD. Interest rates had also been discounting low economic growth rates and the USD reflected slower global economic growth relative to the U.S. We expect that quick reversals of sentiment shifts will continue as long as there is a wide dispersion of opinion on macroeconomic matters and when the financial markets “overly” discount one scenario over another.

Source – Citi, Global Equity Strategy – PMIs Rolling Over: Equity Implications (8/25/2021)

Bottom Line

We believe that the overall equity markets are sustained at these levels mostly due to excess liquidity. As we stated in last week’s letter, we maintain that Q3 earnings will be at risk due to margin compression from higher input costs mostly due to Delta variant related issues. Many equity markets have continued to climb post-peak in terms of the PMI readings for their respective economies.

We surmise that investor sentiment is very fragile and that there is a great dispersion of investor assumptions with respect to economic growth and inflation rates. The overall market is discounting mostly favorable economic and inflation assumptions. Market volatility could begin at any time. We continue to recommend buying desired investments only on downturns. Our key assumption is that the global economy will continue to have a sustained but somewhat irregular recovery.

We expect USD weakness once other countries exhibit stronger economic growth relative to the U.S. as they better manage the Delta variant. We forecast that interest rates should continue their ascent, but in an unpredictable and irregular pattern since they are highly manipulated by the world’s major central banks.

INDEX DEFINITIONS

KBW Nasdaq Bank Index (BKX): The KBW Bank Index is designed to track the performance of the leading banks and thrifts that are publicly-traded in the U.S. The Index includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions.

MSCI EM Value Index: The MSCI Emerging Markets Value Index captures large and mid cap securities exhibiting overall value style characteristics across 27 Emerging Markets (EM) countries.

MSCI EM Index: The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries.

NASDAQ: The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange.

PCE: Personal Consumption Expenditures (PCEs) refers to a measure of imputed household expenditures defined for a period of time.

Russell 1000 Growth: The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted and historical growth values.

Russell 1000 Value: The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

S&P 500: The S&P 500 Index, or the Standard & Poor’s 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S.

VIX: The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options.

Z-Score: A Z-score (also called a standard score) gives an idea of how far from the mean a data point is. It is a measure of how many standard deviations below or above the population mean a raw score is.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2021 NewEdge Capital Group, LLC